Pricing, Planning & Politics: A Study of Economic Distortions in India Subroto Roy

First published on May 29 1984 as Occasional Paper No. 69 of the Institute of Economic Affairs, London

Preface March 2007

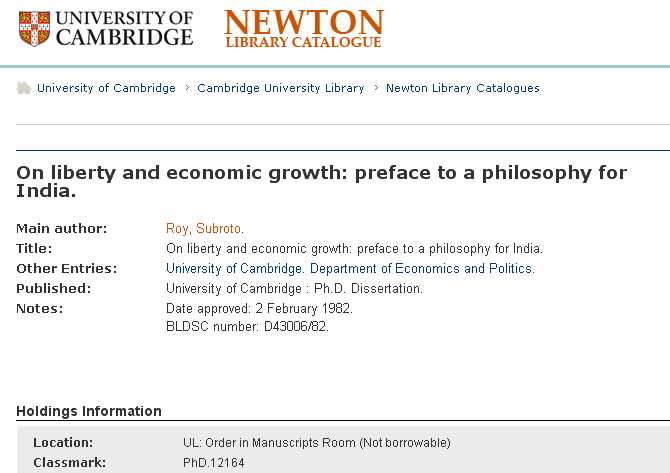

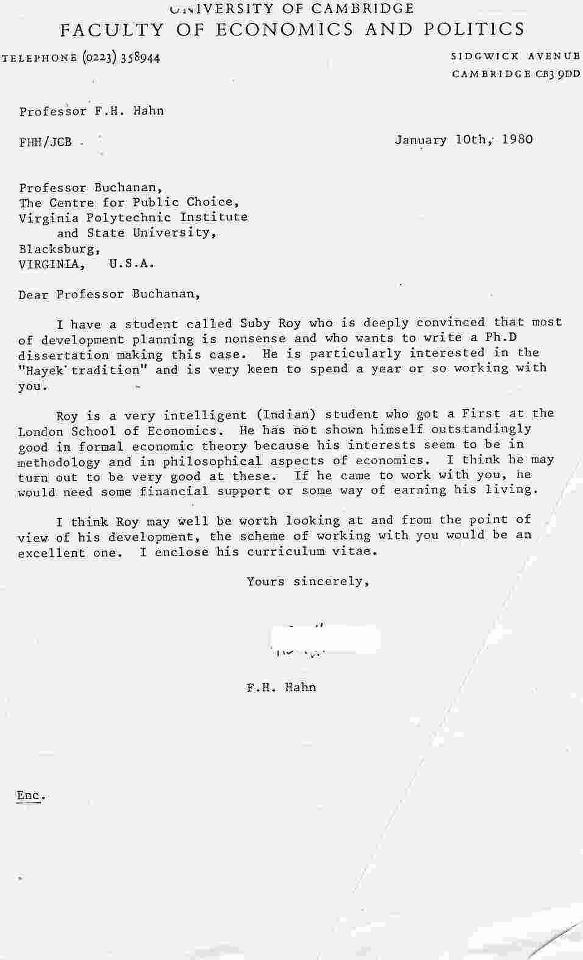

A quarter century has passed since my 1982 doctoral thesis at Cambridge University under Frank Hahn, examined by Christopher Bliss and Terence Hutchison, and titled “On liberty and economic growth: preface to a philosophy for India.” I wrote what follows shortly afterwards in Blacksburg, Virginia, and Ithaca, New York, and it was published on May 29 1984 in London by the Institute of Economic Affairs as Occasional Paper No. 69, ISBN: 0-255 36169-6. The day it was published it turned out to be the subject of the main editorial of The Times, then London’s leading newspaper. (I learnt later this had been due to Peter Bauer, and also that 700 copies sold in the first month, a record for the publisher.) The Times editorial though laudatory was misleading, and I had to clarify the contents of the monograph in a letter published on June 16 1984; both documents are available elsewhere at this site.

This work was the first explicit critique of post-Mahalanobis Indian economic thought from a classical liberal perspective since B. R. Shenoy’s initial criticism decades previously. I was 29 when it was published, I am 52 now. I do not agree with everything I wrote back then and find the tone a little puffed up as young men tend to be; it was five years before publication of my main “theoretical” work Philosophy of Economics: On the Scope of Reason in Economic Inquiry (Routledge: London & New York, 1989, also now republished here). My experience of life in the years since has also made me far less sanguine both about human nature and about America than I was then. But I am glad to find I am not embarrassed by what I said as a young man, indeed I am pleased I said what I did in favour of classical liberalism and against statism and totalitarianism well before it became popular to do so after the Berlin Wall fell. (In India as elsewhere, former communist apparatchiks and fellow-travellers became pseudo-liberals overnight.)

The famous November 1955 Milton Friedman memorandum is referred to herein for the first time as “unpublished” in note 1; I was to meet Milton and Rose Friedman at the Mont Pelerin Society meetings held at Cambridge later that year, where I gave them a copy of this monograph; when Milton returned to Stanford he sent to me in Blacksburg his original 1955-56 documents on Indian planning. I published the 1955 document for the first time in May 1989 during the University of Hawaii perestroika-for-India project that I was then leading, it appeared later in the 1992 volume Foundations of India’s Political Economy: Towards an Agenda for the 1990s, edited by myself and WE James. The results of the Hawaii project reached Rajiv Gandhi through my hand in September 1990, as told elsewhere in “Rajiv Gandhi and the Origins of India’s 1991 Economic Reform”. The 1956 document was published in November 2006 on the front page of The Statesman, on the same day my obituary of Milton appeared in the inside pages (both are republished here too).

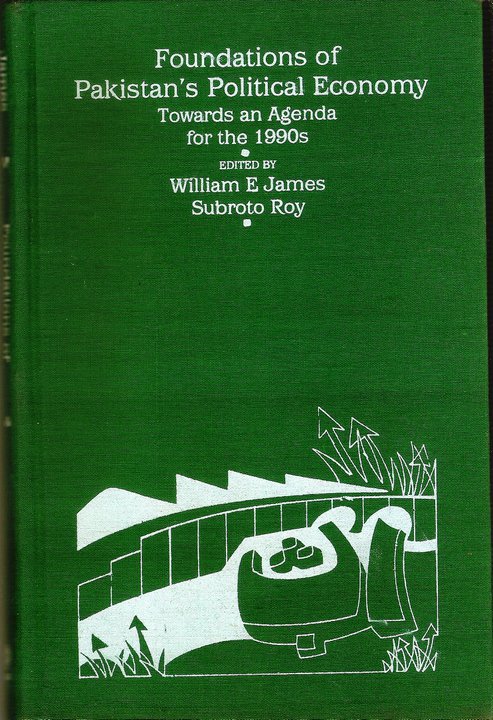

It is apparent from this monograph that I knew almost nothing then about Pakistan or Islam; that has changed as may be seen especially from the other book I created with WE James at the University of Hawaii, Foundations of Pakistan’s Political Economy: Towards an Agenda for the 1990s, as well as my more recent work on Pakistan and Islam. It is of course impossible to understand India without understanding Pakistan and vice versa.

In general, this monograph had to do with India’s microeconomics and theory of value and resource allocation while my latest work – “India’s Macroeconomics”, “Fiscal Instability”, “India’s Trade and Payments”, “Our Policy Process”, “Fallacious Finance”, “The Dream Team: A Critique” . “Against Quackery”, “Growth & Government Delusion” etc – has to do with India’s macroeconomics and monetary and fiscal theory and policy. Part of the criticism of “distorted incentives” prevailing in Indira Gandhi’s India may still be relevant to India today, while the discussion of ethnic problems, agriculture, the “public choice” factors that stymie Indian progress, misgovernance etc will almost certainly be found so.

Pricing, Planning and Politics:

A Study of Economic Distortions in India

First published on May 29 1984 as Occasional Paper No. 69 of the Institute of Economic Affairs, London

“The economic laws which operate in India are the same as in other countries of the world; the causes which lead to wealth among other nations lead to prosperity in India; the causes which impoverish other nations impoverish the people of India. Therefore, the line of enquiry which the economist will pursue in respect of India is the same which he adopts in inquiring into the wealth or poverty of other nations.” Romesh Chunder Dutt, 1906, The Economic History of India

“Satyameva Jayathe” (“Let truth be victorious”), Motto of the Indian Republic

I. INTRODUCTION

IN THE last 15 years, considerable evidence has accumulated to suggest that the most important policies pursued by successive governments of independent India have not been conducive to economic development, and have indeed gone against some of the most basic lessons that political economy has to offer. Forewarnings of the present predicament of India had come from a few economists in the late 1950s and early 1960s, but their arguments were either ignored or maligned as dogmatic and motivated by`ideology’.[1] My thesis in this Occasional Paper will be that, if the basic and commonsensical lessons of political economy had been acknowledged early on in the history of the Indian Republic, we might have found today a much more prosperous economy and a much healthier body politic than is the case.

To argue this, it is first necessary to describe an economy where the pursuit of the individual good by rational agents is conducted within some set of orderly political institutions which is conducive to both civil peace and sustained mass prosperity. Accordingly, Part I of this short Paper begins by describing the broad and familiar features of what may be called a neo-classical or liberal model, and then proceeds briefly to contrast it with a model in which individual incentives and public institutions have been distorted from their efficient characterizations.

The practical question that arises is: Where in practice have independent India’s policies led most conspicuously to distorted incentives and institutions? This will be the subject of Part III. Part II places the discussion in context by briefly describing a few relevant aspects of the political history of the Indian Republic.

I have argued elsewhere that every normative proposal for action is, in principle, open to question and criticism on the logical and factual grounds upon which it is founded. Whenever two people disagree about what ought to be done, it will be found either that at least one of them has made a mistake of logic or that they are also in disagreement about the facts of the case.[2] In Part IV, a tentative manifesto for political and economic reform in India is proposed, and I hope these proposals too will be subjected to critical scrutiny on the positive grounds upon which I shall seek to establish them.

Part I: Theory

2. EFFICIENT INCENTIVES AND INSTITUTIONS

A `FACT’ may be understood as the opposite of that which could have been the case but is not. A basic fact of the study of men and society – one which was acknowledged first by Aristotle and then, very importantly, by Adam Smith, and which has been emphasized in modern times by Friedrich Hayek – is that, while we are able to study and speak of the nature of human decision and action in general terms, we do not and cannot have a knowledge of how particular actions are moved by particular causes and circumstances.[3]

We might certainly know, for instance, that every household in an economy views some horizons, wants to fulfill some aspirations, and faces some constraints. But if we were asked to specify what all these characteristics happened to be as a matter of fact at any one moment, we would certainly not be able to do so. Men are concerned almost wholly with (and are experts at) living their own lives as best they can – foraging for food, shelter and work, celebrating weddings and births, rearing children, and mourning deaths. For the most part, they are neither interested in, nor competent at judging, what others happen to be doing in their private lives. Neither benevolence nor envy extends much beyond a man’s immediate vicinity, and, certainly, neither can extend to people he does not know or come to know of in the course of a lifetime.

This fact is also acknowledged in modern microeconomics, when it is said that, for the individual agent to be able to make decisions and act upon them, it is sufficient for him to know (besides his own desires, abilities and constraints) only of the relative prices prevailing locally of the goods and skills he wishes to trade.`Efficient incentive’ defined We might then provisionally define an `efficient incentive’ as a set of relative prices and wages such that, when economic agents act upon them, three conditions are fulfilled:(i) the difference between the total demand for and the total supply of every good and skill is zero; (ii) every consumer succeeds in trading the amounts of different goods that he desires, and so obtains the highest utility he can within the constraint of his budget; (iii) every private enterprise maximizes the difference between its total revenues and total costs, that is, its profits. [4]

Rational action, however, occurs within a particular institutional context. Which action is rational and which is not will depend on what institutions there are and how well or poorly they function. As both classical liberals and Marxists argue, the neo-Walrasian tradition in modern economics – as exemplified by the Arrow-Debreu model – is practically devoid of any explicit institutional description, and so may best be regarded as a useful but grossly incomplete metaphor in the economist’s inquiry.

The institutions most relevant to economic activity are those of government. We might therefore add a fourth condition to characterize an efficient economy, namely, that government institutions work in such a way as to allocate tax revenues towards providing public goods in the amounts desired by citizens. This must be an institutional assumption implicit in the general equilibrium construction, without which it would be impossible to see the sense of that model.

The question that follows is how we are to ascertain the composition of the set of public goods to be provided. As is commonly known, this seems to confront the economist with numerous conceptual and practical problems. I propose here to circumvent all the typical difficulties of how to discover and combine individual preferences for public goods, or how to prevent free-riders, and to take a somewhat different route.

Functions of civil government: protection, public goods, education

To answer the question `What should be public goods first and foremost? I suggest we look for the kind of answer Adam Smith or Jeremy Bentham or J. S. Mill might have given to a related but different question : `What should be the functions of government in a large civil society, regardless of whether or not it is constituted democratically?’ This was the relevant question before the modern era of mass democracy. And it is still interesting because, first, it probably remains the appropriate question for the many countries today which either do not have democratic governments or do not have long histories of democracy, and, secondly, because the kinds of answer given by classical authors were very similar to those we might expect from individual citizens in modern democracies as well.

The most important practical functions of civil government include defence against external aggression, the dispensing of civil and criminal justice, the protection of life, property and trade – broadly, the Rule of Law – and the pursuit of a judicious foreign policy. All are different aspects of the same broad objective of ensuring the survival of the community and the security of individual life.

Yet no pretext has been more common than that an imminent danger to the security of the community requires the government to take despotic measures. The guarantee by a civil government of the freedom of inquiry, discourse, criticism, and historical research should take precedence, therefore, even over ensuring security and survival, for it is probably the only final check there can be on whether what a government says is or is not in fact the case. Where this freedom is forcibly denied, or where it exists but people are too apathetic, ignorant or busy with their daily lives to exercise it, public life soon becomes self deceptive and absurd, with propaganda taking the place of discourse, and pretensions and appearances diverging more and more from attainments and reality. Wherever the questions `What is true?’ or `What is the case?’ are not asked frequently enough, there will be fewer and fewer correct answers as to what the case happens to be.[5]

After collective and individual security, the functions of government include the building of dams, embankments, bridges and canals, the provision of roads and fresh water, and so on – activities which, as Adam Smith put it, “. . . though they may be in the highest degree advantageous to a great society, are, however, of such a nature that the profit could never repay the expence to any individual or small number of individuals, and which it, therefore, cannot be expected that any individual or small number of individuals should erect or maintain.” [6]

Each may be more or less a “pure” public good in the modern sense :“that each individual’s consumption of such a good leads to no subtraction from any other individual’s consumption of that good”.[7]

Such a list could be extended to include activities as diverse as: the prevention of soil erosion; the public finance of school education, and’ of measures of basic public health such as vaccinations against contagious diseases; the issuing of currency; sewage disposal; population censuses; the standardization of weights and measures; and so on. It is unnecessary to be more specific here since some people will find even this list controversial. Dogmatists will deny the need for free inquiry; pacifists will dispute that defence is a public good; communists will protest against the public protection of private property; `anarcho-capitalists’ will contest the public dispensation of justice; and so on. To these critics, I would offer merely the following short and incomplete reply.

First, a sound argument can be made that what functions civil government should have can be ascertained, without prejudice, by reasonable citizens, though which particular functions these are may well vary according to circumstances. Secondly, if we could spend time in thoughtful and leisured conversation with every citizen of a large community, it might be predicted – as a matter of cold, empirical fact – that practically everyone would agree with the suggestion that the first destinations of tax revenues should indeed be activities like defence, civil protection and the Rule of Law, the provision of roads, and so on. If such a prediction is correct, my thesis is plainly much more democratic than it might appear to modern economists, though I shall later claim that an objective defence of democratic institutions can be made on quite different grounds as well.

If there is a clear family resemblance between classical liberal authors – from Smith and Mill through to Hayek, Robbins, Friedman, Buchanan, Bauer and many others – it has to do, not so much with the denunciation of government activity in the market-place, as with the recognition of the existence of certain duties of government outside it, the fulfillment of which are indispensable to civil life, let alone the pursuit of economic prosperity. Their protest is at the high opportunity cost of the alternatives foregone.

This raises the question of how we might tell whether government is working well or badly in a particular country at a particular time, or, generally, how we might tell whether different public goods are provided in too small or large amounts. For present purposes it will again be sufficient to suggest a very rough and common sense way of proceeding: let us look first, and think second.

For example, the Iran-Iraq war has clearly been a perfect public bad as far as the ordinary citizenry in either country are concerned. Similarly, if there happen to be millions of cases queuing outside the courts waiting to be heard, or if crime is rampant and police protection ineffective, that may constitute prima facie evidence that too few public resources have been devoted to civil order and justice. Or, if heavy rainfall annually causes landslides in the hills and floods in the plains, devastating crops and leaving innumerable citizens destitute, that also might prompt us to ask whether sufficient public resources have gone towards precautions against such havoc. And so on.[8]

Which goods happen to be public goods depends on the circumstances and the level of government being discussed. For similar circumstances and levels, similar goods will most likely be public goods in different countries. The state ordinarily consists not only of the national government but also of several provincial governments and a myriad of local governments. In particular, a premise of the liberal state would be that public goods should in fact be provided by various levels of government, financed through taxes paid respectively at those levels. The citizen is a taxpayer at a variety of levels, and accordingly public goods are due to be provided at a variety of levels. Just as the national government may not usurp the power to tax for, or spend money on, a public good which is best provided by a provincial government to the citizens of a province, so a provincial government may not tax for, or spend on, a public good best provided by a local government to the citizens of a locality.

The broad principle involved has two aspects: first, a recognition that knowledge of particular circumstances – and hence the ability to act – is infinitesimally dispersed within a population; and, secondly, as direct and visible a matching as possible of the benefits a citizen receives from a particular public good with the taxes he pays towards it, thereby perhaps reducing his incentive to be a free rider on the contributions of others.8Uncertainty and ignoranceProvisionally, therefore, efficient incentives may be thought to consist of a set of market-clearing relative prices and wages, occurring within an institutional context in which the basic and indispensable functions of government have been adequately performed at a variety of appropriate levels.

Such a definition would still be seriously incomplete in one major respect. For we must now recognise: (i) that history is unique and irretrievable, that the present consists only of the fleeting moment, and that the future, by its very nature, cannot be fully known; (ii) that such a thing as human freedom exists; and (iii) that, as a consequence, uncertainty and ignorance are ubiquitous.

Some of the uncertainty derives from the unfolding of natural events (like the rains) over which man has little or no control. The rest derives from the fact that the individual is a free agent who is affected by the actions of others but who cannot predict those actions completely because they too are free agents like himself. Game theory would have had no appeal for the economist if the existence of human freedom had not been a fact. It is this which makes it impossible to read everything in another person’s mind and thus makes it impossible to predict everything he might do. The lasting contribution of Keynesian economics could be its emphasis that such uncertainty and ignorance are important to the economist’s inquiry.

Mathematical economists have been saying for several years that what is required if we are to be realistic are models which reflect the sequential character of actual decision-making and account for the past being immutable and the future uncertain.[9] However, they have proceeded to write even more complex mathematics than we already have – disregarding Aristotle’s advice not to seek more precision from the subject of an inquiry than it may be capable of yielding.[10] My question is the more mundane one of what becomes of the classical liberals’ concept of efficient incentives and institutions in a dynamic world. I shall answer it too in a pedestrian way.

The single overwhelming reason why uncertainty and ignorance are relevant to the economist’s descriptions is that they make real the possibility of mistakes by economic agents. To extend the previous discussion to a dynamic context, what we can do is to ask which institutions are most likely to reduce or mitigate the social consequences of mistaken decisions, whether made by private agents or by those in public office. And it is here that the classical liberals advocate two important institutional features: competition and the decentralisation of decision-making.

The major value of democratic institutions over authoritarian ones is that they encourage these two principles to be put into effect. Because, in a large economy, particular knowledge is infinitesimally dispersed, it may be better for adjustments to a multitude of variables to be made continuously in response to changing circumstances by a vast number of small economic agents, rather than for adjustments to a few variables to be made at political intervals by a small group of very powerful agents. The concentration of power to make major decisions among a few fallible men is a much more ominous prospect than the distribution of power in small amounts among a large number of fallible men. It is much more dangerous for a monopoly of ideas to be claimed about where the political good of a country lies than for there to be free and open competition among such ideas at the bar of reason.

D. H. Robertson put it well when he warned “that all the eggs should not be in the same basket – that in this highly uncertain world the fortunes of a whole trade, or a whole area, should not depend on the foresight and judgement of a single centre of decision”.[11] The presumption in favour of democratic institutions is that they reduce the potential damage from wrong political decisions damage which can be rationally expected in an uncertain world.[12] Elections, in the liberal understanding, are then not so much the means to promote the interests of one’s confederates as to remove from office without bloodshed rulers who fail to do what they are entrusted with, and to replace them by those from whom better is expected. Economic efficiency in an uncertain worldThe economic notion of efficient incentives is also modified by uncertainty and ignorance. In the theory, a set of prices is market clearing only relative to unchanging preferences, resources and technologies. In a dynamic world, however, demand and supply functions are themselves changing and the notion of efficient incentives must accordingly be adapted to one in which relative prices move in the direction of the excess demand: that is, if the parameters change so that the total demand for a good or skill comes to exceed the total supply, we should want to see its relative price rising (and, conversely, if total supply exceeds total demand, we should want to see its relative price falling). During such a process of adjustment, many people may suffer very considerable hardship – something which reasonable Keynesians do well to emphasise.

If changing preferences, resources or technologies cause the demand for a product to diminish, we should want to see the firms which manufacture it either entering different markets, or improving its quality by technological innovation, or lowering prices. Similarly, we should want to see workers in these firms whether blue- or white-collar – who have skills specific to a product whose price is falling either increasing their productivity or retraining themselves in different skills more specific to the manufacture of goods whose prices are rising. Numerous enterprises can go bankrupt, and numerous workers can find themselves unable to sell the skills they possess, if they fail to adapt quickly enough to changing market conditions. The more specialised the product and the more specific the skill, the more hardship there may be. There could well be orthodox Keynesian consequences whereby laid-off workers reduce their consumption expenditures and firms on the verge of bankruptcy reduce their investment expenditures, leading to lower incomes for others, and thus to lower expenditures by them too, and so on. An anti-Keynesian who denied the existence of such hardship would be closed to the facts. He might also not be doing his own theory justice: for it is not unreasonable to argue that, while adjustments are inevitable in an uncertain world, the classical response of prices moving in the direction of excess demand probably minimises the hardship in the transition from one equilibrium to the next.

In a dynamic world, therefore, in which supply and demand functions are shifting continually and unpredictably (though probably incrementally, and not drastically), efficient incentives are better thought of as relative prices which are not stagnant but which are moving – and moving quickly – in the direction of excess demand. It should, in general, be continually profitable at the margin for firms and workers to be innovating technologically and improving productivity. As everyone knows from experience, the principle goad to such activity is fair and free competition. If a job or contract is sought badly enough, and if better quality or lower price are known to be the only criteria of selection, the expected outcome is a differentiation and improvement by competitors of the individual quality or price of what is sold.

In broad summary, the liberal understanding of how material well-being can be improved rests on the assumption that the basic functions of civil government are performed satisfactorily. Government provides the backdrop of civil order and protection necessary for private citizens freely and fairly to conduct their own lives and their transactions with one another. It is a theory which acknowledges a fundamental fact in the study of society, namely, that the individual household : (a) most commonly defines its own horizons; (b) knows the particular opportunities available to it to produce, trade and consume; (c) recognises the particular constraints which prevent it from doing all that it may desire; and(d) perceives how these opportunities and constraints may be changing. Where, as in the liberal picture, there are large numbers of producers and consumers, sellers and buyers – each family acting more or less independently – the efforts of one family do not directly make for other than its own success, while at the same time the repercussions of its mistakes are felt by itself and do not reverberate throughout the whole community. Such has been, as I see it, the American secret to mass prosperity.

3. DISTORTED INCENTIVES AND INSTITUTIONS

DISTORTED INCENTIVES are the logical opposites of efficient ones. Relative prices and wages send distorted signals to individual economic agents when they do not move in the direction of excess demand, so that there is no general tendency for markets to clear. A long-run or endemic excess demand for a good reveals itself in rationing, queueing and black markets. The price at which trade nominally takes place is too low and shows no tendency to move upwards.

Conversely, in a product market, a long-run or endemic excess supply reveals itself in surpluses and spoilages. In a labour market, it reveals itself, on the one hand, in armies of tenured employees who have no incentive to improve productivity, and, on the other hand, in lines of involuntarily or disguised unemployed who cannot sell all the skill they possess and have to settle for selling their less-specialised ones. The price at which trade nominally takes place is too high and shows no tendency to move downwards. In practical terms, firms do not find it profitable to be continually entering new markets or improving quality or enhancing technology or reducing price in order to attract and retain customers. Farmers in particular may face output and input prices which make technological improvements unprofitable.

In politics, distorted incentives are ones which make it profitable for politicians and government officials to be corruptible and taxpayers to be evasive. Because corruption is not penalised and honesty not rewarded, the pursuit of private interest may make it rational to be corrupt and irrational to be honest.

Individualism and statism

A neo-classical economic model like the one outlined above presupposes among citizens a political attitude of individualism. This may be defined as a condition in which citizens have the idea (a) that it is the individual household itself which is principally responsible for improvements in its own well-being, and (b) that government merely “is, or ought to be, instituted for the common benefit, protection and security of the people …”, and that government officials are merely the citizens’ “trustees and servants, and at all times amenable to them.” [13]

Its logical opposite may be called an attitude of statism – defined as prevailing when various classes of citizens have the idea that it is government which is and should be principally responsible for improvements in individual and public well-being. A good sense in which `power’ can be defined in political and economic contexts is as “the capacity to restrict the choices open to other men”.[14] An attitude of statism entails a willingness, or at least an acquiescence, on the part of citizens to relinquish to those in government, with little or no questioning, the power to make decisions which may affect their lives intimately. At the same time, responsibility for relapses or lack of progress in individual well-being is also thought to be the consequence of governmental and not private decision-making. Whereas individualism is a self-assertive attitude, statism is a self abnegating one. For those in government to have a statist mentality is the same as saying they are paternalistic, that is, making the presumption that the citizen is often incapable of judging for himself what is for his own good.

The suggestion that government should have the principal responsibility for improvements in individual and collective economic well-being – in the sense that the collectivity can and should satisfy the material aspirations of every individual – appears straightaway to be self contradictory. An individual can have enough difficulty trying to articulate his own horizons, aspirations and constraints, let alone trying to do the same for others. For a politician (or economist) to claim (or imply) not only that he knows(or can know) the relevant characteristics of everyone at once, but also that he knows how to ameliorate the condition of humanity at a stroke, as if by magic, would have been considered ridiculous in more candid times than ours. If we understand `collective effort’ to mean the sum of individual labours engaged in a common pursuit or endeavour, then for the collectivity to try materially to satisfy every individual would amount to imposing a duty on everyone to try materially to satisfy everyone else – an absurd state of affairs, flying in the face of the fact that most people most of the time do not wish to, or cannot, cope with much else except their private lives.

Exhorting government directly to improve the material wellbeing of `the people’ cannot mean what it seems to because it cannot refer to literally all the people but only to some of them perhaps only a majority, or only the well-organised. That the state is endogenous to the polity implies that no government has resources of its own out of which to disburse the amounts a politician may promise or an economist recommend. To fulfil new promises, given an initial condition of budgetary equilibrium, a government is only able either to print more fiat money or to tax the resources of individual citizens more heavily. Leaving aside the first alternative, fulfillment of the exhortation amounts to using public institutions to transfer resources from some people in order to keep promises made to others.

When the attitude spreads that, in politics, one man’s gain is another man’s loss, and where political control is to be had by winning majorities in elections, the citizen comes to face a perverse incentive to try to coalesce with more and more others in the hope of capturing the public revenues in his favour – instead of thinking critically about the nature of the political good as the institutions of democracy require him to. Political power becomes less dispersed, and the size of the polity diminishes in the sense that it comes to have fewer and fewer constituent agents, each of which is a larger and larger coalition of like-minded confederates intent on acquiring control for its own benefit.

Perhaps the worst consequence of a general attitude of statism, however, is that the basic, commonsensical functions of government are obscured, ignored, and neglected. Instead of requiring politicians and government officials to fulfill these functions, a citizenry allows its public agents to become brokers and entrepreneurs – trading not only in the products of government controlled industries but also in an array of positions of power and privilege, all in the name of directing a common endeavour to help the poor. The state places itself at every profitable opportunity between private citizens who might otherwise have conducted their transactions themselves perfectly well. The result is that governments do, or try to do, what either does not need to be done or ought not to be done by government, while they neglect that which only governments can do and which therefore they ought to be doing.

Part II: History

4. INDIVIDUALISM AND STATISM IN INDIA

AN ATTITUDE of statism has probably been present in India since Mughal times at least. If anything, it spread during the British period since the raison d’être of British rule in India would have vanished without paternalism (as in the course of time it did) and the existence of British rule was the raison d’être of the nationalist movement. Paternalism towards India was espoused even by those Englishmen known for their liberal views at home. Thomas Macaulay, for instance, declared to the House of Commons in 1833: “It may be that the public mind of India may expand under our system till it has outgrown that system; that by good government we may educate our subjects into a capacity for better government; that having become instructed in European knowledge, they may, in some future stage, demand European institutions. Whether such a day will ever come I know not. But never will I attempt to avert or retard it. Whenever it comes, it will be the proudest day in English history.”[15]

Less than a hundred years later, in 1930-31, the Indian National Congress – to the considerable chagrin of the British Government – resolved to bring about an independent India in which every citizen would have the right to free speech, to profess and practise his faith freely, and to move and practise his profession anywhere in the country. There would be universal adult suffrage and no-one would be unjustly deprived of his liberty or have his property entered, sequestered or confiscated. In particular, all citizens in the future republic would be `equal before the law, irrespective of religion, caste, creed or sex’, and no disability would attach`to any citizen by reason of his or her religion, caste, creed or sex, in regard to public employment, office of power or honour, and in the exercise of any trade or calling’.[16]

These resolutions were made in the thick of the battle for independence, and underscored the fundamental argument of the nationalists that, in spite of the infinitely diverse characteristics of the inhabitants of the sub-continent, a free and secular India was possible in which all would be ruled by a common law. That argument had been in contradistinction to the frequent taunt from British Conservatives that an

India without Britain would disintegrate in internecine bloodshed, and also to the later `two nations’ theory of the Muslim League which led eventually to the creation of

Pakistan. With the departure of the British and the Pakistanis, in 1950 the Constitution of the first Indian Republic was finally able to bring into force the idea of secularity which had inspired the nationalist cause. Thus, among the Fundamental Rights established by the Constitution, Article 14 provided that the state `shall not deny to any person equality before the law or the equal protection of the laws within the territory of

India’. Articles 15.1, 15.2, 16.1, 16.2 and 29.2 went on to prohibit discrimination on the arbitrary grounds of religion, race, caste, sex or place of birth in matters of public employment or access to publicly-funded education.

The century between Macaulay and the resolutions for independence was by far the most important to the country’s intellectual history since earliest antiquity. While it took its turbulent course, long severed since the time of the early Greeks – came to be re-established. The common interest and the common contribution became one of admiring and learning from Europe and from India’s own past what there was to be admired and learnt, whilst forsaking and resisting what was self contradictory or base. The maxim for a century might have been : learn the good and let the evil be buried in history. As Tagore wrote :`The lamp of Europe is still burning; we must rekindle our old and extinguished lamp at that flame and start again on the road of time. We must fulfill the purpose of our connection with the English. This is the task we face in the building up of a great India.’[17]

The ideal aspired to was swaraj, or `self rule’. It literally meant not only a government of India by Indians accountable to Indians, but also the governance of the individual by himself. Not only was the country to be sovereign vis-à-vis other states; its individual citizens were to be free vis-à-vis each other and equal before its laws. Swaraj meant, in other words, a condition of political autonomy where the citizen constrained his own free actions so as not to harm others, and where the Rule of Law would protect him when he acted autonomously and resist him when he did not. Given a backdrop of civil order, the infinite number of ways to individual happiness and prosperity in an infinitely diverse sub-continent could then be pursued. Statism all pervading

An attitude of statism, however, has pervaded all public discourse in independent India, and has been reinforced by the social and economic policies pursued by successive governments.

In the first place, a ghost from earlier controversies with the British was to remain in the 1950 Constitution. Immediately after the provisions establishing equality before the law and equality of opportunity in public employment and publicly funded education, the following caveats appeared. Article 15.3 said that the state could make “any special provision for women and children”; and then, of more significance, Article 15.4 allowed the state to make “any special provisions for the advancement of any socially and educationally backward classes of citizens or for the Scheduled Castes and the Scheduled Tribes”.

Article 16.4 allowed it to make “any provision for the reservation of appointments or posts in favour of any backward class of citizens which, in the opinion of the State, is not adequately represented in the services under the State.” Lastly, Article 335 said that “the claims of the members of the Scheduled Castes and the Scheduled Tribes shall be taken into consideration, consistently with the maintenance of efficiency of administration, in the making of appointments to services and posts [under the State] . . .” Who was to decide who was `backward’ and who was not, or which group was to be `scheduled’ and which not? Article 341.1 said that `The President may . . . by public notification specify the castes, races or tribes which shall for the purposes of this Constitution be deemed to be Scheduled Castes’, and Article 341.2 added that `Parliament may by law include in or exclude from the list of Scheduled Castes specified under 341.1 any caste, race or tribe or part of or any group within any caste, race or tribe . . .’ Articles 342.1 and 342.2 said the same for the Scheduled Tribes.

Subsequently, two Presidential Orders named no fewer than 1,181 different groups in the country as `Scheduled Castes’ and more than 583 other groups as `Scheduled Tribes’. Roughly a sixth of the population thus came to be termed `backward’ by executive decree and were segregated by statute from the rest of the citizenry.

The direct precursor of these provisions was the `Communal Award’ by the British Government in 1932, who had taken it to be their duty “to safeguard what we believe to be the right of Depressed Classes to a fair proportion in Legislatures ”.[18] (`Depressed Classes’ was the official name for those misleadingly called `untouchables’ outside the Hindu fold.)

The complex customs of the Hindus call for endogamy and commensality among members of the same caste, thus making anyone outside a caste somewhat `untouchable’ for its members. In marriage and dining habits, many orthodox Hindus would hold foreigners, Muslims, and even Hindus of other castes at the same distance as those formally classified as `Depressed Classes’. Indeed, non-Hindus in India -including the British often maintained social protocols that were equally as strict.

No serious Indian historian would doubt that members of the `Depressed Classes’ had been oppressed and had suffered countless indignities throughout Indian history at the hands of so-called`caste Hindus’. At various times, persecution had led to mass conversions to the more secular faiths. But the ancient wrongs of the Hindu practices had to do not so much with the lack of physical contact in personal life which the word `untouchability’ connotes for Indian society has always consisted of a myriad of voluntarily segregated groups – but rather with open and obvious inequities such as the denial of equal access to temples, public wells, baths and schools.

Gandhi, who by his personal example probably did more for the cause of the `Depressed Classes’ than anyone else, protested against the Communal Award with one of his most famous fasts. Privately, he suspected that `…the communal question [was] being brought deliberately to the forefront and magnified by the government because they did not intend to part with power’.[19] Publicly, he argued that the pernicious consequence would be a further exacerbation of the apartheid under which the `Depressed Classes’ had suffered for so long, when the important thing was for their right to be within the Hindu fold to be acknowledged by `caste’ Hindus.[20]

The Fundamental Rights in the 1950 Constitution establishing the equality of all citizens before the law evidently had the 1930-31 resolutions as their precursors; while Article17 – which specifically declared `untouchability’ to be `abolished’ and its practice `forbidden’ – was part of Gandhi’s legacy, placing those who had for centuries been denigrated and persecuted on exactly the same footing in the eyes of the laws of the Republic as their denigrators and persecutors. The subsequent clauses authorizing the state to discriminate in favour of `Scheduled Castes’, and allowing it to define by executive decree who was to be so called, were evidently the remnants of the Communal Award of 1932. Discrimination by the state was initially to last for a period of 10 years only. It has, however, been extended three times -for another 10 years on each occasion – and so continues to the present day. We shall examine a few of the consequences in Part III.‘A socialistic pattern of society’As for economic policy, while the original 1950 Constitution had ambiguously stated certain ends – such as that government was `to strive to promote the welfare of the people’ – it made no mention at all of any specific economic institutions, statist or liberal, which the new Republic was to nurture as means towards those ends. In spite of this omission, successive governments have explicitly avowed their espousal of` socialism’ as the means to the good and prosperous society.

For instance, a “socialistic pattern of society where the principal means of production are under social ownership or control” was declared to be a national objective at the ruling Congress Party’s convention in 1955; and, in 1976, the notorious 42nd Amendment purported to change the very description of the country in the preamble to the original Constitution from the sober `Sovereign, Democratic Republic’ to the awkward `Sovereign, Secular, Socialist Democratic Republic’. It is an open and important issue of constitutional practice whether a temporary majoritarian government can change the legal description of a republic so fundamentally that it necessarily begs every question now and in the future about the efficacy of socialism as the route to mass prosperity.[21]

Even so, `socialism’ is a vague and equivocal word, meaning different things to different people. Briefly, what happened in the Indian context seems to have been that the Nationalist Government explicitly took upon itself the responsibility of becoming the prime mover of the economic growth of the country. This was in addition to its other fundamental and urgent political responsibilities at the time, namely, to establish peace and civil order in the aftermath of a bloody partition, re-settle several million destitute refugees, integrate into the Republic the numerous principalities and fiefdoms run by the princes and potentates, re-draw provincial boundaries on a sensible linguistic criterion, and generally educate people about their rights and responsibilities as individual citizens in a new and democratic republic.

In a poor country which had just ended a long period of alien rule, it was understandable, if in advisable, that a nationalist government led by cultured, educated men among unlettered masses should take upon itself the responsibility for economic growth. Part of the nationalists’ critique of British rule had been precisely that it had worked to the considerable detriment of the Indian economy. And, certainly, whatever the exact calculation of the benefits and costs of the British presence in India, while there had been obvious benefits, there had also been obvious costs such as iniquitous taxes and overt racial discrimination in employment. [22]Thus, when the nationalists practically swore themselves to provide better government for the economy, it was certainly a very praiseworthy aim; 1947 would indeed be the year of India’s `tryst with destiny’.

Better government not necessarily more government

What the Nehru Government came to believe, however, was that better government for the economy necessarily meant more government activity in the economy. A similar nationalist government led by cultured, educated men among an unlettered public had chosen differently in 1776 at Philadelphia, but the times and circumstances were very different. The Indian nationalists, and most especially Prime Minister Nehru, had just witnessed what they took to be, on the one hand, the collapse of the market economy in the Great Depression and, on the other, the rapid growth to greatness of Bolshevik Russia. In his presidential address to the Congress in 1936, for instance, Nehru spoke of the immediate past in these terms: `Everywhere conflicts grew, and a great depression overwhelmed the world and there was a progressive deterioration, everywhere except in the wide flung Soviet territories of the USSR, where, in marked contrast with the rest of the world, astonishing progress was made in every direction . . .’ Thus, it seemed to him, there was`. . . no way of ending the poverty, the vast unemployment, the degradation, and the subjection of the Indian people except through Socialism”. Socialism meant, inter alia, ` the ending of private property, except in a restricted sense, and ttte repla emenr of the ,private profit system by a higher ideal of co-operative service. It means ultimately a change in our instincts and habits and desires. In short, it means a new civilisation, radically different from the present capitalist order. Some glimpse we can have of this new civilisation in the territories of the USSR. Much has happened there which has pained me greatly and with which I disagree, but I look upon that great and fascinating unfolding of anew order and a new civilisation as the most promising feature of our dismal age. If the future is full of hope it is largely because of Soviet Russia and what it has done, and I am convinced that, if some world catastrophe does not intervene, this new civilisation will spread to other lands and put an end to the wars and conflicts on which capitalism feeds’.[23]

Equally as certain and deep as his admiration for the liberal values of the West was Nehru’s evident misunderstanding of the causes and consequences of Stalin’s Russia. The political and economic history of India in the past 30 years cannot be understood without regard to her most powerful leader’s ambivalence about the nature of the political and economic good.

By the mid-1950s, many of India’s other prominent statesmen had died or retired from public life, and there was hardly a public figure of’ stature left (with the exception of Rajagopalachari) to challenge Nehru’s socialist vision of the country’s future. Moreover, men who were ostensibly `expert economists’, but whose writings revealed no knowledge of prices or markets or the concept of feasibility, were encouraged to endorse and embellish this vision, which they did without hesitation in the secure knowledge that they were shielded from critics by the intellectual patronage of a charismatic and elected leader.[24]

The choice between alternative models of mass economic prosperity must have seemed quite clear at the time. The cold fact did not, however, vanish that one of the oldest objective lessons of political economy has been that more government is not necessarily better government. It is to the consequences of ignoring this lesson that we now turn.

Part III: Practice

ECONOMIC POLICIES IN INDEPENDENT INDIA

INDIA TODAY is a bizarre maze of distorted incentives, which I (and no doubt others) have found very difficult to untangle and understand. I shall, however, list and discuss the most significant of them as methodically as I can.

(i) Industry

The Indian Government has declared a large `public sector’ in commerce and industry to be a national objective. Towards this end, it has therefore progressively acquired numerous enterprises, large and small, so that it now has either a full monopoly in an industry or is one of a few oligopolists. These industries range from banking, insurance, railways, airlines, cement, steel, chemicals, fertilisers and ship-building to making beer, soft drinks, telephones and wrist-watches. There are no explicit penalties for indefinite loss-making; indeed, bankrupt private enterprises have often been nationalised to serve politicians’ ends. And, certainly, there has been no general rule of marginal-cost pricing. In public utilities, like electricity generation and distribution or city buses and trams, prices appear to be well below marginal cost, leading to severe rationing and queueing. Sudden stoppages of electricity for hours at a time and monumental congestion on buses and trams have become endemic facts of life for millions of urban Indians.

At the same time, private industry in India has been made to face labyrinthine controls. The government has continually exhorted private firms to work in the `national interest’ – which means accepting the constraints of centralised planning. It has left no doubt that, while there is a `role’ for the min the growth of the economy, they exist at the sufferance of government and had better realise it, otherwise the dark forces of revolution which have so far been kept at bay will inevitably sweep them away altogether, as happened in Russia and China.

The constraints imposed on the operation of a private business are legion, and would make a businessman from the West or Far East reach for a psychiatrist or a pistol. An entrepreneur may not enter numerous industries without government approval of the `technical’ viability of his project; once it is approved, he cannot find credit except from a government bank; and he cannot buy raw materials and machinery of the highest quality at the lowest price since, if they are produced in India, he will be denied a licence to import better and/or cheaper foreign substitutes. The onus is on him to satisfy the government that no production occurs within India of the input he requires; only then will an import licence conceivably be granted, subject to periodic review by the government. He may be compelled to export a specified proportion of his output as a condition for the renewal of his import licence, which therefore places him at a disadvantage with foreign buyers who, of course, are aware of this restraint. He may be unable to compete internationally because the rupee is priced above its likely equilibrium and some of the inputs he uses are high-cost, low-quality domestic substitutes. As a result, he may be compelled practically to dump his output abroad at whatever price it will fetch.

The entrepreneur’s factory may be subject to random cuts in electricity for hours at a time. He may require government approval before he can increase his fixed capacity, modernise his plant, change a product-line, or even change the number of labour shifts. He may face minimum-wage and stringent unfair dismissal laws on the one hand, and price controls on the other. If he fails to meet credit obligations to the nationalised banks, he may be penalised by the appointment of one or more government directors to his board – a form of `creeping’ nationalisation. Further, he may be subjected to a constant threat of full nationalisation as and when the government decides that his industry should be in the public sector in the interests of national planning.[25]

The consequence of all these controls has been a monumental distortion of incentives away from encouraging private firms to try to attract customers by improving technology and quality or reducing prices towards encouraging them to concentrate on `rent-seeking’, in the term made familiar by Professors Gordon Tullock and James Buchanan.[26]

As Anne Krueger says in her excellent study of the automobile ancillary industry, the very notion of entrepreneurial efficiency changes in such circumstances: `Under conditions in India, the most important problem confronting entrepreneurs is that of assuring that production will continue. The combined effects of import licensing and investment licensing give virtually every firm a monopoly or quasi-monopoly position. The entrepreneur who is most successful in getting licences of greater value and/or in getting licences more quickly than his fellow producers will have higher profits. `The producer who does not compete successfully for licences cannot produce at all, no matter how skilled he is in achieving engineering efficiency, unless he enters the “open market” and pays a premium to the successful licence applicant for some materials . . . Successful entrepreneurs are therefore those who are best at obtaining the greatest number of licences most expeditiously . . .’ [27]

Moreover, firms which are low-cost and efficient (in the free market sense) and which are successful at rent-seeking as high-cost, inefficient firms may still not be able to compete the latter out of business because government will not usually allow a particular firm to expand – regardless of its efficiency – if there is excess capacity in the industry of which it is a part. High-cost firms can thereby rationally count on staying in business simply by maintaining significant excess capacity.

(ii) Foreign trade

The Government of India has always claimed that foreign exchange is a `scarce’ resource which must be rationed by fiat in the national interest. The total foreign-exchange revenue (at an exchange rate which was fixed until 1971 and has since been on a managed `peg’) has been allocated in the following order of priorities: first, to meet foreign debt repayments and government expenditures in the conduct of foreign policy, such as the maintenance of embassies (G1); secondly, to pay for imports of defence equipment, food, fertilisers and petroleum (G2); thirdly, to meet ear-marked payments for the imported inputs of public sector industries so that they may achieve projected production targets (G3); fourthly, to pay for the imported inputs of private sector firms which are

successful in obtaining import licences (P1); and, lastly, to satisfy the demands of the public at large for purposes such as travel abroad (P2).

Foreign exchange is `scarce’ in India, or elsewhere, in precisely the same sense that rice or petrol or cloth is scarce. Just as there exists some positive price for rice, petrol or cloth which, at any moment, will match total supplies with total demands, so there exists some positive price for rupees relative to dollars which, at any moment, will match the transaction and asset demands of Indians for dollars with the transaction and asset demands of foreigners for rupees. Underlying that market-clearing price would be (a) the demands of Indians for foreign goods whose f.o.b. prices were lower than those of domestic substitutes, and, similarly, the demands of foreigners for goods in which India has had a comparative advantage; and (b) the expectations of Indians and foreigners about the future purchasing power of the rupee relative to the dollar, using as a proxy, say, the difference between interest rates in India and abroad.

A free market in foreign exchange would first have encouraged India’s traditional exports, like jute manufactures and textiles, and then (if the positive theory of international trade is broadly correct)progressively encouraged the export of other non traditional goods which used India’s relatively inexpensive labour relatively intensively and thereby enabled Indian entrepreneurs to compete successfully in foreign markets. At the same time, capital flows into and out of India would have given the monetary authorities an incentive to keep domestic interest rates in line with the real opportunity cost of forgoing consumption in favour of savings.

Thus, the case against a free market in foreign exchange has always been, to say the least, far from obvious.[28] But even if, for the sake of argument, we accept the presumed superiority of rationing, the elementary theory of optimisation which underlies the so-called theory of `planning’ dictates that the government should allocate dollars between alternative uses such that the marginal dollar yields the same increase in social utility in any use. The Indian Government, however, appears to have allocated foreign exchange simply on the basis of giving a higher priority to its own foreign expenditures (categories Gl, G2 and G3) than to private foreign expenditures (categories Pl and P2). That is to say, regardless of how much social utility might have been derived from a particular increase in private-sector imports, it would not be considered until after the government had met all its own expenditures abroad.[29]

Jagdish Bhagwati and T. N. Srinivasan put it as follows : `The allocation of foreign exchange among alternative claimants and users in a direct control system . . .would presumably be with reference to a well-defined set of principles and criteria based on a system of priorities. In point of fact, however, there seem to have been few such criteria, if any, followed in practice.’[30]

With respect to imported inputs for private- and public-sector industries, a rule of `essentiality’ (that is, the input must be technically `essential’ to the production process) and a rule of `indigenous availability’(that is, there must be absolutely no domestically-produced physical substitutes, regardless of cost and quality)seem to have been followed. But, as Bhagwati and Srinivasan report, `. . . the sheer weight of numbers made any meaningful listing of priorities extremely difficult. The problem was Orwellian: all industries had priority and how was each sponsoring authority to argue that some industries had more priority than others? It is not surprising, therefore, that the agencies involved in determining allocations by industry fell back on vague notions of “fairness”, implying pro rata allocations with reference to capacity installed or employment, or shares defined by past import allocations or similar rules of thumb’. [31]

Clearly, in abjuring the free market and claiming a monopoly over foreign-exchange transactions, government planners have accepted certain premises as unquestionable: (a) that government sponsored industrialisation is the best means to mass prosperity; (b) that a policy of indefinite import-substitution is the best means to industrialisation; and (c) that such a policy requires all foreign expenditures by government to take precedence over all private foreign expenditures. The trade and foreign-exchange policies pursued cannot be understood except by reference to domestic economic policies and, in particular, to the view held about the proper functions of government in and out of the market-place.

In addition to a plethora of controls, tariffs and outright bans on imports, there have been erratic policies, subsidising the export of `new’, non-traditional manufactures like engineering goods, and taxing- and even banning – the export of goods in which India has traditionally enjoyed a comparative advantage.[32]

Moreover, the rupee has been continuously over-valued. From 1949 to 1959, the official exchange rate of Rs. 4.76 to the US dollar was, on average, 12..3 percent above the black-market rate, a figure which rose to 61 per cent between 1960 and 1965. From 1966 to 1970, the devalued official rate of Rs. 7.50 to the dollar was above the black-market rate by an average of 47.6 per cent, while from 1971 onwards the managed-peg rate has been above the black-market rate by an average of 24.3 per cent.[33]

Simple economics suggests that a free-market equilibrium rate would be somewhere between the black-market and official rates. An official exchange rate for the rupee fixed above that warranted by underlying relative demands for Indian and foreign goods, as well as by relative degrees of confidence in the rupee and the dollar, subsidises imports at the expense of exports. By discriminating in favour of its own foreign expenditures and against those of the private sector, the government has been the principal beneficiary of an over-valued rupee. If capital-intensive goods are the main imports and labour-intensive ones the main exports, an over-valued rupee further distorts incentives so as to favour the use of capital-intensive production processes over labour intensive ones – in a country with a demonstrable abundance of relatively inexpensive labour!

With an eye to India, Krueger has argued the general issue in these terms:`Subsidies can make any industry an export industry, even one that would not produce at all in an efficient allocation. Similarly, taxes can be levied on an industry that has comparative advantage which will penalize it enough to render domestic production entirely unprofitable. When taxes and subsidies are used, therefore, it is possible not only to distort the structure of production, but to distort it so much that the “wrong” commodities are exported.”[34]

The Indian Government’s planners have had the idea of forcibly effecting a reversal in the comparative advantage of the country, as if by magic overnight. The hope might have been that a forced pace of industrialisation would somehow allow economies of scale to be reaped and thus soon make Indian industrial goods competitive enough in international markets to be the country’s principal source of foreign exchange, displacing traditional manufactures like jute and textiles. In practice, however, as the evidence given by Bela Balassa

and other economists demonstrates, such a policy has not succeeded to date and is most unlikely ever to do so.

India’s import bill has risen continuously, most drastically after the 1973-74 quadrupling of petroleum prices; non-traditional manufactures have hardly been able to compete successfully in foreign markets; and the traditional exports of jute and textiles have suffered very severe setbacks. Balassa contrasts the consequences of the freer, outward-looking trade policies of South Korea, Singapore and Taiwan with those of the inward-looking, controlled regime of India as part of a study of 11 countries(including Argentina, Brazil, Colombia, Mexico, Chile, Israel and Yugoslavia) which, along with Hong Kong, account for most of the manufactured exports of developing countries. India’s share of the total manufactured exports of these countries has fallen steadily from 65.4 per cent in 1953 to 50.7 per cent in1960, to 31.2 per

cent in 1966 and to a mere 10.3 per cent in 1973. The proportion exported of India’s total manufactured output fell from 9.7 per cent in 1960 to 9.4 per cent in 1966 and to 8.6 per cent in1973. In contrast, during the same two periods, the proportion of manufactured output exported rose from1 to 14 to 41 per cent in South Korea, from 11 to 20 to 43 per cent in Singapore, and from 9 to 19 to 50 per cent in Taiwan.[35]

Balassa cogently argues that the adverse effects of a sudden change in external factors, such as the quadrupling of petroleum prices in 1973-74 or the 1974-75 Western recession, were absorbed much more easily by developing countries with large foreign-trade sectors than by those like India with relatively small ones: `Outward orientation is associated with high export and import shares that permit reduction in non-essential imports without serious adverse effects on the functioning of the economy. By contrast, continued inward orientation involves limiting imports to an unavoidable minimum, so that any further reduction will impose a considerable cost in terms of growth. Furthermore, the greater flexibility of the national economies of countries pursuing an outward-oriented strategy, under which firms learn to live with foreign competition, makes it possible to change the product composition of exports in response to changes in world market conditions, whereas inward orientation entails establishing a more rigid economic structure.’[36]

In other words, if imports are both high in total value and diverse in composition, a rise in the relative price of a particular import for which home demand is relatively inelastic (like petroleum and its products) can be accommodated by a substitution of expenditure towards it and away from inessential imports for which demand is relatively elastic. A similar argument had typically been advanced by advocates of import-substitution when they maintained that the exports of a small country should be diverse and not concentrated on only a few goods since a decline in world prices would otherwise lead to serious falls in export revenues. This suggests that both critics and advocates of import substitution might agree that, for a country which is a price-taker in world markets, the encouragement of a large foreign-trade sector is a way of diversifying the risk of adverse effects from changes in world prices. The question remains as to whether the positive theory of trade is correct in saying that the encouragement of comparative advantage is superior to import-substitution as a means of achieving a large foreign sector. From the contrasting experiences of, say, South Korea on the one hand and India on the other, the answer seems overwhelmingly to be that it is.

(iii) Agriculture

The Indian Government has instituted a multiple-pricing system for the major food-grains, especially rice and wheat. Farmers are compelled to sell a specified fraction of their output to the government, at a price fixed by the government which is significantly lower than that warranted by underlying supply and demand conditions. Farmers may sell the remainder of their output freely. The quantities the government acquires in this way, plus any it imports (imports being subsidised by the over-valuation of the exchange rate), are sold by ration at lower than free-market prices in the so-called `fair-price’ shops – which happen to be mainly in urban areas. Urban consumers may purchase part of their requirements from such shops and the remainder on the open market at higher prices. Astute middle-class urban housewives know that rationed grain is often of poorer quality than that sold on the open market. Accordingly, the former often constitutes part of the wages of the domestic servants of the urban household, while the family consumes the latter. Insofar as this is true, it suggests that farmers distinguish quality much better than do government officials, and that they use this advantage somewhat to partition their output into low- and high-quality, selling the first under compulsion to the government and the second on the open market.

While such is the general food policy of India, the compulsory procurement of grains and their distribution to the ration-shops is implemented by individual State governments and not by the Union Government. There have usually been numerous restrictions on inter-State movements of grain, so the States do not form a full customs union; instead, the Union Government tries to be a central clearing-house, matching the desired imports of one State with the desired exports of another.[37]

Economic effects of ban on futures contracts

Furthermore, futures contracts in grains have been banned by law, in the belief that futures trading is conducive to speculation and that speculation is undesirable. A futures contract in grain consists simply of a promise by a seller to deliver an amount of grain to a buyer at some specified date in the future in return for payment at a price agreed today. The seller’s incentive to enter into the contract is the guarantee of a certain sale, and the availability of funds now; the buyer’s incentive is the guarantee of a certain price for future deliveries. The contract may be entered into because buyer and seller have different expectations about what the spot price will be in the future. The buyer minimises his expected costs and the seller maximises his expected revenues; both are able to balance their budgets inter-temporally. Even if they have the same expectations about future spot prices, buyer and seller may still find it mutually profitable to enter into a futures contract as a way of insuring against risk. Forbidding such contracts by decree thus forces more risk onto both buyer and seller than they would normally be prepared to carry, and also induces them to balance their accounts in each period rather than it inter-temporally. Alternative kinds of credit markets become it relatively more lucrative, with the potential seller and buyer of futures wheat respectively borrowing and lending more than they would otherwise have done.[38]

The government has also expressed its determination to keep prices in ration-shops low. It has accordingly stockpiled large inventories of grain, apparently regardless of the costs of storage and spoilage or the alternative of holding larger foreign-exchange reserves to permit increased imports when necessary.

The ostensible, declared objective of all such policies has been to ensure that the poor do not suffer severe adverse income effects from sudden rises in the price of food resulting (it has been thought) from the contingencies of rainfall and the actions of speculative traders. It is, however, an open secret that the policies have really been a means of (a) taxing farmers, who pay a smaller percentage of their income in direct and indirect taxes than do urban dwellers, and (b) subsidising urban consumers, who broadly comprise the industrial working class and the middle in classes.

At the same time, however, the government and its advisers — after the considerable hesitation recorded by David Hopper [39]- have also accepted that the best long-run prospects for increasing agricultural productivity lie in modernising traditional farming techniques. Given the outstanding results of the Green Revolution in wheat, they could hardly have arrived at any other conclusion. The problem from the government’s point of view has been, as a sympathetic economist puts it “…how to procure a sufficient quantity of food grains at reasonable prices without jeopardising the farmers’ incentives to produce more”.[40]

Thus, while taxing farmers de facto on their output, on the one hand, the government has tried, on the other, to promote the use of modern inputs by subsidizing them both directly and through low-interest loans from the banks for such investment.

Distortions of incentives in agriculture

The distortions of efficient incentives caused by such policies are not difficult to see. First, the low output prices of wheat and rice have, in effect, been discriminatory taxes on wheat. As Edward Schuh remarks, these discourage the production of `. . . the very crops that policy-makers believe the vulnerable groups should have greater access to . . .’[41]

Vasant Sukhatme and Theodore Schultz have argued that, even between wheat and rice, there has been severe discrimination in favour of the former. At the official over-valued exchange rate, the price of domestic wheat has been significantly higher than imported, while at open-market rates for the rupee, the domestic price approximated the import price. For rice, however, the domestic price has been consistently below the import price. Sukhatme estimated that the dead weight loss in welfare from the under pricing of rice amounted to 8.5 per cent of total agricultural income in 1967-68 and to 2.2 per cent in 1970-71. He also calculated effective rates of protection, which were strongly negative for rice whether at official or open-market exchange rates and positive for wheat at the official exchange rate. Both he and Schultz conclude that the discrimination against rice has been a major factor in explaining the absence of a Green Revolution in rice on the scale of that in wheat.[42]

Secondly, the main beneficiaries of government subsidies for modern inputs have evidently been not the many small farmers but the fewer relatively large ones. As Gilbert Brown reports :`Large-scale farmers buy most subsidised inputs. Poorer farmers usually lack the money to buy adequate amounts of fertiliser and pesticides, and are commonly unable to get credit except at near-prohibitive rates of often 60% to 100% per year. Even in countries with subsidised bank credit for agriculture, rich farmers get most of the credit because of legal or administrative restrictions and/ or through open or disguised bribery. Credit and subsidy programmes for tractors, tube wells and other fixed investments also go mostly to the largest and richest farmers . . .Water is also a subsidised input . . . The farmers who receive this subsidised water generally have substantially higher incomes (because of the water) than farmers without access to public irrigation. Thus, claims that water should be subsidised to help small farmers misses the point that most farmers with irrigation have higher incomes than those who do not.’[43]

Brown argues that subsidies for inputs have been made necessary only to offset the forced depression of output prices. Moreover, the social benefit from subsidising inputs is limited to when the input is first introduced: ‘Once the benefits and technique of using the input are widely known, however, the continuation of such subsidies serves largely to increase the benefit-cost ratio of using the input . . .’.

Whether it is better to continue with artificially low input and output prices or to adjust towards a free market in both must take into account that the subsidies have encouraged more capital-intensity in production, and also that the `. . . low prices of certain inputs, particularly water, are often associated with widespread waste and inefficient use of the resource’.[44]

Thirdly, the farmer who is too small to find investment in storage facilities profitable may also consider it not worth his while to hold any of his output for sale on the open market. He will then sell it all to the government – at a below-market price.

A general conclusion would seem to be that, if the combined effect of input subsidies and forced grain sales to government has been a net subsidy to agriculture, then it has been a progressive subsidy; whereas if the combined effect has been a net tax on agriculture, then it has been a regressive tax. The Marxists may be quite right to protest that what gains there have been in agriculture have accrued to the relatively larger farmers, while smaller peasants and farmers are becoming landless labourers in growing numbers as a result of bankruptcy (that is, there has been increasing `rural proletarianisation’, to use the Marxists’ picturesque phrase). But if this is true, the cause can be traced unambiguously to the Indian Government’s belief – vociferously shared by the Marxists – that the way towards the declared objective of helping the poor is by extensive interference in the price system. Besides, the industrial working class demonstrably benefits from low food prices, so the honest Marxist must face up to being torn by divided loyalties between the rural and the urban proletariats.