I have said here recently that some of the wisest advice President Obama or any leader anywhere can receive is that contained in Oliver Cromwell’s famous words “Think it possible you may be mistaken”.

This seems especially significant in context of new American macroeconomic and financial policies. Mr Steve Clemons reports today there may be less intellectual diversity in the new President’s economic team than is possible or desirable; if so, conversation may become stifled and a greater propensity towards groupthink may arise, hence a greater likelihood of mistakes.

It is possible the directions that different people might like to see the conversation extended are different, and that would be a good sign of course! For example, someone might think a Barro or a Mishkin could be the right addition of intellectual diversity, whereas others might suppose that to be the wrong direction towards more “market fundamentalism”. But it would be a pity if the economic conversation within the new Administration came to be artificially or ideologically circumscribed in any direction.

Certainly I believe macroeconomic policy-discourse in the United States or elsewhere needs to proceed to a recognition of the existence of JM Keynes’s original concept of “involuntary unemployment” as well as to ask whether the actual unemployment happens to be or not be of this sort. (It may be “frictional” or “structural” or “voluntary” or “seasonal” etc, not the involuntary unemployment Keynes had meant.) Furthermore, even if significant involuntary unemployment is identified, it needs to be asked whether government policy can be expected to improve or worsen outcomes. The argument must be made either way, and, in John Wisdom’s phrase, “Argument must be heard”.

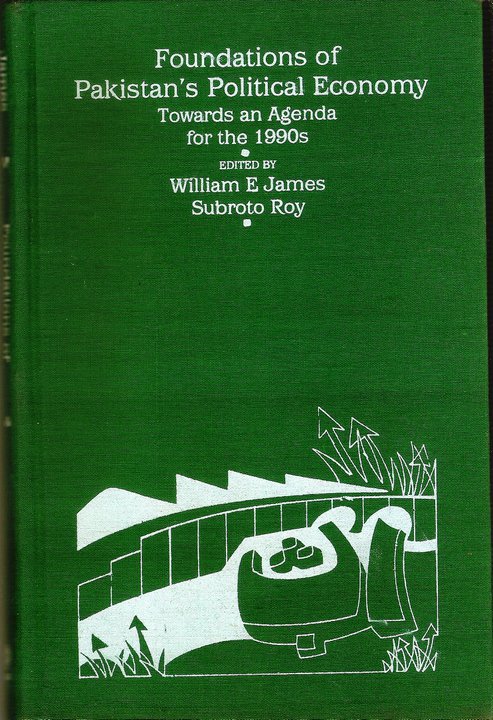

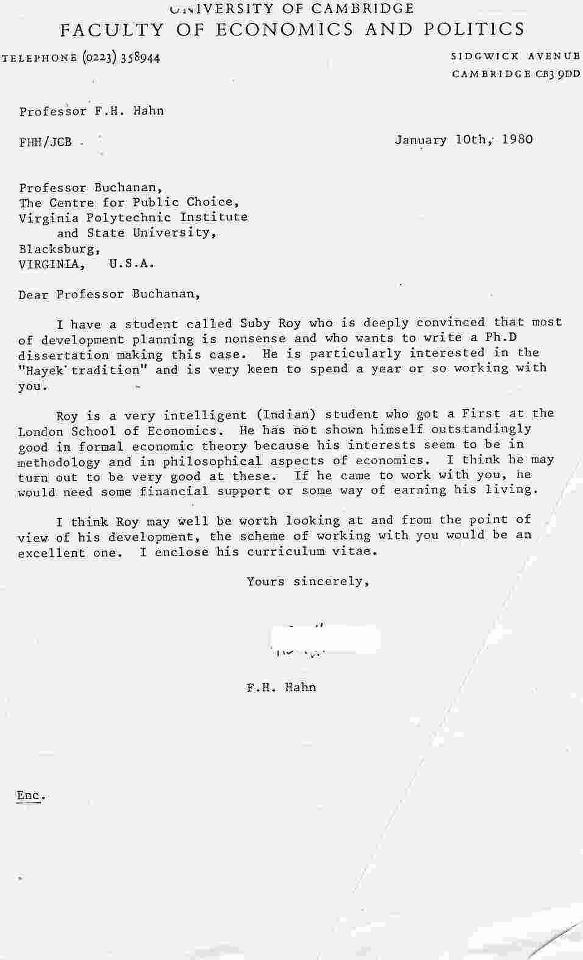

“A Dialogue in Macroeconomics” which was Chapter 8 of my 1989 book Philosophy of Economics (Routledge, Library of Congress HB 72.R69) may provide some useful ballast. The saga that followed the book’s publication left me unable to write about the US economy anymore, except briefly in 1992 and 1994-95 in Washington and New York, read only by a few friends. Now in late 2008, I have published “October 1929? Not!” and “America’s divided economists” which may be of interest too, and which are republished below as well.

I have also added a couple of sundry points from an international perspective that I pointed to last September-October, namely

(i) foreign central banks might have been left holding more bad US debt than might be remembered, and dollar depreciation and an American inflation seem to be inevitable over the next several years;

(ii) all those bad mortgages and foreclosures could vanish within a year or two by playing the demographic card and inviting in a few million new immigrants into the United States; restoring a worldwide idea of an American dream fueled by mass immigration may be the surest way for the American economy to restore itself.

Subroto Roy

I.

from Philosophy of Economics Routledge 1989

“Chapter 8.

A Dialogue in Macroeconomics

OUR next example is of quite a different sort, namely, the academic debate which has occurred in macroeconomics and monetary theory since Keynes’s General Theory of Employment, Interest and Money. This has of course received a great amount of attention, with innumerable commentaries having been written by many scores of protagonists and moderators around the world. Only a brief and highly simplified summary of these many conversations can be attempted here, within our limited objective of illustrating once more how it may be possible for critical discussion to be seen to proceed freely and yet objectively in economics. In the previous chapter we were fortunate to have had an actual conversation to consider; here our method shall have to be one of constructing a model of a conversation. In honour of Plato, we might name our conversants Athenian and Stranger.

ATHENIAN Tell me, have you perhaps been following the discussions among macroeconomists? I shall be interested to know what you take their present state to be.

STRANGER Indeed I have, though of course it is not possible or worthwhile to follow all of what has been said. But yes I have followed some of it, and certainly we can make it a topic of conversation.

ATHENIAN Please begin.

STRANGER Very well. Shall we do so in ‘36 with the publication of Keynes’s book? Rightly or wrongly, this must be considered a watershed in the history of modern economics, if only because most economists since have had either to admit its arguments in some measure or define and explain their disagreement. You’ll remember at one time it was said by many that Keynes had fathered a revolution in economic science.

ATHENIAN Except Chicago and the Austrians.

STRANGER Quite so. Now more recently a renewal of neoclassical thought has been under way, and many doubts have been raised about the keynesian consensus, so much so that some of the main questions of the thirties seem in modern form to continue to be at issue today.

ATHENIAN The more things change, the more they stay the same! But when you say Keynes has been a central figure, I take it you mean only that he has been among the most influential and most discussed and nothing more. It is not to preclude judgement on the merits of his book, which is itself of very uneven clarity. Besides there has been too much idolatry and hagiography.

STRANGER Yes, there is so often a rush to belief and worship. There may have been less if Keynes had survived longer. Yet I should say the broad aim of the work is not hard to see. Keynes himself clearly believes that he is starting a revolution — going so far as to suggest a comparison with contemporary physics. The first chapter says the book aims to provide a “general” theory, which will explain the traditional model as a “limiting” case. The second chapter says the theory of value has been hitherto concerned with the allocation of given resources between competing ends; Keynes is going to explain how the actual level of employment comes to be what it is.

ATHENIAN And so begs the question?

STRANGER Or does traditional theory? That seems to be at the heart of it.

ATHENIAN Go on.

STRANGER The theory will be of the short run in Marshall’s sense of taking capital as a fixed factor. Traditional theory is said to postulate about the labour market (i) that the real wage equals the marginal product of labour, so there is an assumption of profit maximization by competitive producers giving rise to a short run demand curve for labour; and (ii) that the utility of the wage at a given level of employment equals the marginal disutility of that amount of employment; i.e., the real wage is just sufficient to induce the volume of labour which is actually forthcoming. So it can account for unemployment due to temporary miscalculations, or intermittent demand, or the refusal or inability of labour to accept a job at a given wage due to legislation or social practices or collective bargaining or obstinacy, or merely a rational choice of leisure — i.e., it can account for frictional and voluntary unemployment but not for what Keynes wants to call involuntary unemployment. What it can suggest is either such things as improvements in foresight, information, organization and productivity, or a lowering of the real wage. But Keynes’s critique will not have to do with such causes of the contemporary unemployment; instead the population is said to be seldom “doing as much work as it would like to do on the basis of the current wage…. More labour would, as a rule, be forthcoming at the existing money wage if it were demanded.” But it is not being demanded, and it is not being demanded because there has been a shortfall of “effective demand”. That is why there is as much unemployment as there is.

ATHENIAN Or so Keynes claims. And he would take it the neoclassical view would be that it must be the real wage is too high; it is only because the real wage has not fallen by enough that unemployment continues.

STRANGER Right. To which there are two observations. The first has to do with the actual attitude of workers towards the money wage and the real wage respectively. The traditional supply function of labour is a function of the latter; Keynes claims that at least within a certain range it must be workers are concerned more with the former.

ATHENIAN How so?

STRANGER By the interesting and perhaps plausible claim that workers are found to withdraw labour if the money wage falls but do not seem to do the same if the price level rises. A real wage reduction caused by a fall in the money wage and the same real wage reduction caused by an increase in prices seem to have different effects on labour supply. “Whether logical or illogical, experience shows that this is how labour in fact behaves.” And he cites U. S. data for ‘32 to say labour did not refuse reductions in the money wage nor did the physical productivity of labour fall yet the real wage fell and unemployment continued. “Labour is not more truculent in the depression than in the boom — far from it.”

ATHENIAN And the second observation?

STRANGER This may be of more interest. “Classical theory assumes that it is always open to labour to reduce its real wage by accepting a reduction in its money wage… [it] presumes that labour itself is in a position to decide the real wage for which it works…” Keynes does not find a traditional explanation why prices tend to follow wages, and suggests it could be because the price level is being supposed to be determined by the money supply according to the quantity theory. Keynes wants to dispute the proposition “that the general level of real wages is directly determined by the character of the wage bargain…. For there may be no method available to labour as a whole whereby…. [it] can reduce its real wage to a given figure by making revised money bargains with the entrepreneurs.” Hence he arrives at his central definition of involuntary unemployment: if the real wage falls marginally as a consequence of the price level rising with the money wage constant, and there is greater employment demanded and supplied in consequence, the initial state was one of involuntary unemployment.

ATHENIAN You are saying then that Keynes’s intent is to establish the existence of involuntary unemployment?

STRANGER At least a major part of the intent yes. To make the concept meaningful, to argue that it refers to a logical possibility, and also that much of the actual unemployment of the time may be falling under it, and is a result of lack of “effective demand”.

ATHENIAN The neoclassicals have been said to be cavalier about fluctuations in economic activity, when in fact Wicksell and Marshall and Thornton, let alone Hawtrey or Hayek as Keynes’s own critics, certainly had profound enough theories of the cycle. Before we go further, I think we should remind ourselves of what they actually said.

STRANGER Very well.

ATHENIAN Would you agree that can be summarized, then as now, as the quantity theory of money married to the theory of general equilibrium?

STRANGER Though it may be better to speak of divorce perhaps rather than marriage, in view of the dichotomy.

ATHENIAN From Smith to Mill, political economists broadly agree the role of government should extend and be restricted to such activities as defence, civil protection, the rule of law, the provision of public goods, education, the encouragement of competition, and so on. The traditional agenda does not as a rule include direct activity to restrain or otherwise change the natural course of trade, production, or consumption, and certainly no theory of what today is called macroeconomic policy. Underlying it is a broad belief that the competitive pursuit of private welfare within the necessary and minimal framework of the institutions of government, will result in tolerable social outcomes, and any further activity may be counterproductive. The State is after all endogenous to the economy, without any resources to its own name.

STRANGER The minimal state, though not so minimal perhaps as we sometimes think.

ATHENIAN The main function of money is seen to be that of facilitating real transactions. Hence the main component of the demand for money is the transactions demand, and the broad objective of monetary policy is the maintenance of the stability of the price of money. But this is recognized to be something elusive in practice, and fluctuations in economic activity are expected to occur in spite of the best intentions of the monetary authorities.

STRANGER How so?

ATHENIAN Well we might imagine two or three distinct but related markets: one for real investment and savings determined by intertemporal preferences, resources, and technologies; one a market for investment and savings defined in terms of money; one a short term credit market. The market for real investment and savings is, as it were, unobservable to the naked eye. Yet it drives the second and third markets for nominal savings and investment in which we actually participate. Monetary equilibrium requires the observable money rates of interest to equal the unobservable real rate of return on the market for physical capital. In particular, the real or natural rate of interest determined in the equilibrium of the first market is not, and perhaps ultimately cannot be, affected by nominal or monetary disturbances in the second or third markets.

STRANGER Why call it “natural”?

ATHENIAN In the sense it is a function of the real data of intertemporal preferences, resources, and technologies being what they are. If these data changed it should be expected to change too. But given these data, it would be the rate at which intertemporal constrained maximizations by individual agents resulted in planned present consumption equaling planned present production at the same time as planned future consumption equaled planned future production.

STRANGER In other words, real planned savings equal real planned investment.

ATHENIAN Exactly. It is the real interest rate, or rather the whole structure of own-rates and cross-rates at various terms, which is the key price signal for macroeconomic equilibrium.

STRANGER “Natural” seems to me to carry a physiocratic connotation. A better nomenclature would replace it with something else — perhaps “equilibrium real rate” or just “walrasian” rate.

ATHENIAN Very well, though I for one do not bias myself against the physiocrats! Now consider how a simple business cycle might occur on wicksellian lines. From a position of full real and monetary equilibrium, an expansion of credit has its first effect on the banks, increasing reserves and inducing more lending for reserve/deposit ratios to be restored, and so lowering the loan rate. But customers are only able to perceive a lowering of this nominal rate of interest and cannot know the equilibrium real rate has not changed. As far as households know, the relative price of present consumption has fallen and there is an incentive for greater consumption and lesser savings. As far as businesses know, the relative price of the future good has risen, and there is an incentive for greater investment. Inventories are run down, and markets for both consumer goods and capital goods are stimulated and show signs of excess demand. But if there was a walrasian equilibrium initially, then the economy will now show signs of inflation; with a gold standard, there would be increased demand for imports and an external drain of reserves, and even perhaps an internal drain if there was a panic and a run on the banks. The loan rate will have to rise once more to reign in reserves, but if the rate is now raised too high relative to the still unchanged real rate, there would be the makings of a recession.

STRANGER Your point being that economists before Keynes had recognized the decentralized economy may be fluctuating continually.

ATHENIAN Surely they had done so quite fully. A first set of causes such as wars, disasters, discoveries and migrations would change the real data of the economy, while a second set would be monetary disturbances like the failure of the authorities to adequately follow the dictates of the real data of the economy, i.e., failure to observe the equilibrium real rate of interest. It may even be intrinsic to the problem that they must fail in the attempt to observe, let aside compute, the equilibrium real rate warranted at a given time by the structure of the real data.

STRANGER Hence the conclusion that they cannot hope to do better than establish a climate of monetary and fiscal stability, such as by declaring a long term policy and staying with it.

ATHENIAN Exactly. Private economic agents already face endemic uncertainty with respect to changes in the real data, and must be assumed to not want more added by government policy. You appear to have seen my point nicely.

STRANGER Very well. But you have jumped ahead as this kind of a conclusion sounds very modern to me. You made me stop all the way back at Keynes’s notion of effective demand!

ATHENIAN As I said, the more things change, the more they stay the same.

STRANGER Let us go back a little. I think we may be able to rejoin our initial route at a point which may bring us close to where we seem to have come by the route you have taken. Specifically suppose we go back to the question of the money wage and the real wage, and of the real wage being “too high”.

ATHENIAN That has been interpreted a number of ways, has it not?

STRANGER Yes it has. One would be to say Keynes was merely simple minded and assumed money illusion on the part of workers. Another would be to say Keynes assumed a short run context of fixed prices, so it would not make a difference whether labour happened to be concerned with changes in the real or the money wage. Yet a third would be to say Keynes, whether he realized it or not, had come upon a recondite truth about the sort of complex monetary economy in which we live — namely, that when transactions are quoted and made in a monetary economy, it may become difficult ipso facto for the walrasian equilibrium to be achieved. Even workers might fully recognize the real wage to be too high and be prepared to work more at a lower wage, but be unable to signal this willingness to potential employers.

ATHENIAN So involuntary unemployment becomes another sort of equilibrium outcome.

STRANGER Exactly. Not only of labour but of machines too, along with the unintended holding of inventories. It is as if firms would have sold what they had planned to if only workers had the income to buy it, which they would have done if only they had been able to sell as much labour they had planned to, which they would have done if only there had been an effective demand for it, which there would have been if firms had not cut back on production because they found themselves unable to sell what they had planned to sell. A kind of vicious circle, due to pessimistic and self-fulfilling expectations all around.

ATHENIAN An unhappy solution to a non-cooperative game you might say.

STRANGER Quite so. Keynes does not deny there may be a monetary route out of the impasse. A wage deflation would eventually lead to price deflation, raising the real value of money holdings, so via liquidity preference lead to an increased demand for bonds, raising their price and lowering money interest rates, which through the investment function would lead eventually to increased effective demand. But the fiscal route may be more direct and quicker in its effect on expectations. Trying to deflate across the board in the face of what seem to be excess supplies of goods and labour might be counterproductive, causing unexpected transfers from debtors to creditors and precipitating bankruptcies. Instead: “Government investment will break the vicious circle. If you can do that for a couple of years, it will have the effect, if my diagnosis is right, of restoring business profits more nearly to normal, and if that can be achieved then private enterprise will be revived. I believe you have first of all to do something to restore profits and then rely on private enterprise to carry the thing along….”

ATHENIAN A shot in the arm for enterprise in the hope of breaking the pessimism. But Keynes was hardly alone in such thinking.

STRANGER Quite true.

ATHENIAN And he certainly seemed to treat the opinions of others without due respect, which is to say he may have exaggerated the significance of his own. Hinting that he was the Einstein of economics set an especially bad example. Only the other day one eminence was comparing himself to Newton, and another was calling his friend Shakespeare. It will be Joyce and Pasternak next!

STRANGER Flattery and nepotism are common weaknesses, my friend. Like the rush to belief and worship.

ATHENIAN Besides you would have to assume the government to be outside the game, and only so being able to see the problem which private agents could not from inside the game. That may be too large an assumption, don’t you think?

STRANGER Yes it may. Yet it seems to me pump-priming was a possible solution being offered to a temporary problem. Many of the controversies may have come about because it became institutionalized, because discretionary fiscal policy became a permanent part of the government agenda.

ATHENIAN And a more direct route out was available too, was it not? With wealth placed in the consumption function directly, a deflation would increase the real value and affect effective demand directly. We would not have to wait for the roundabout effects through so-called liquidity preference.

STRANGER Which in a way brings us back to a central pillar of traditional theory: with given real data and given velocity of circulation, desired holding of real money balances will roughly be constant. In particular the demand for real money balances should not be seen as a function of the interest rate.

ATHENIAN The real rate or the monetary rate?

STRANGER For neoclassicals certainly the real; Keynes does not seem clear.

ATHENIAN There may lie a problem.

STRANGER The title of the book says “Employment, Interest, and Money”. No question employment is real and money is money — interest is the bridge. If you ask me to bet I would say Keynes’s agents make real responses to signals expressed as they must be in a large economy in monetary terms.

ATHENIAN Perhaps we ought to move on. Tell me, if you think Keynes’s book rightly or wrongly ranks as the most influential document of the last fifty years, would you agree it is Friedman’s address on the role of monetary policy which must rank second to it if not on a par with it?

STRANGER Certainly there can be few competitors.

ATHENIAN Well then, it appears to me the net effect of Friedman’s critique has been a restoration of the wicksellian theory and a banishment of the keynesian theory.

STRANGER Friedman of course makes his approach via a critique of the Phillips’ Curve.

ATHENIAN Yes, but it is Wicksell whom he acknowledges in advancing the notion of a natural rate of unemployment, one which has been “ground out by the walrasian system of general equilibrium equations” — in other words, one which happens to be consistent with the structure of the real data of the economy at a particular time.

STRANGER Though again we may as well speak of walrasian instead of natural.

ATHENIAN A monetary policy which tried to peg unemployment at lower than such a rate (if such a rate could be determined, which it cannot) is likely to be counterproductive. The initial effect of an expansionary policy on a walrasian equilibrium may be to increase real output. Workers assume the increase to reflect an increase in the unobservable real demand for their services, and hence they expect a higher real wage. Businesses see the same and assume it to reflect an increase in the unobservable real demand for their goods. But given there was no real excess demand in the first place for either labour or goods, the effect outside anything but the short run will be a return to the initial structure of real wages, and the temporary decline in unemployment is reversed to the walrasian rate at higher prices. If the government tries to maintain unemployment at less than the walrasian rate, it will have to concede — indeed it will have caused — accelerating inflation without any real fall in unemployment.

STRANGER And vice versa perhaps, so there would be a kind of knife-edge.

ATHENIAN Now your remark about Friedman making his approach via the Phillips Curve seems to me interesting. We may have been too hasty to make a comparison with the debate in the thirties. For the world suffers a very real and severe shock between Keynes’s book and the keynesian consensus, which is the Second World War itself.

STRANGER I am not sure I follow.

ATHENIAN Well think of the consensus afterwards on the need for macroeconomic policy — it is actually Tinbergen’s notion of a “policy-maker” which is married to what seems to be Phillips’s finding of a trade-off between inflation and unemployment. It becomes the role of the macroeconomist to advise the politician on how to minimize social disutility from inflation and unemployment subject to the Phillips Curve. Macroeconomics becomes a so-called “policy science”. Give your expert economist your social utility function, and he will tell you where to slide to on your Phillips Curve.

STRANGER The available instruments being money supply and tax rates. That is what I meant in saying Keynes’s idea became institutionalized.

ATHENIAN It seems to me this consensus is born out of the War.

STRANGER How so?

ATHENIAN Well just think of the structural problems of the time: demobilization of large armies, reconstruction, all the displaced peoples, and so on. What are democratic governments to do? Say to their voters, right, thank you very much, now could you please go home quietly? What could have been expected except an Employment Act? Governments were going to help their returning citizens find work, or at least it would have seemed irresponsible if they had not said they were going to.

STRANGER You are saying then that Friedman may have been arguing against a new orthodoxy, grown out of what might have been a sensible idea.

ATHENIAN Exactly. The world is a very different place now than in 1945, in ‘45 than in ‘33, in ‘33 than in 1914. Real shocks every time. It may be a grave mistake for us to look for a unique and universal theory which is supposed to explain all particular circumstances, all of history.

STRANGER Reminds me of the historical school.

ATHENIAN Why not? Again I hold no prejudice against them! Anyhow, consider that Lucas and others have followed Friedman to argue it is a mistake to formulate the problem as Tinbergen had done, with unemployment as a target in a social utility function along with inflation. If it ought to be assumed that people will not continually make the same mistakes in predicting policy, then a systematic employment policy is going to be discovered quickly enough and rendered either ineffective or counterproductive. This idea too has its origins in Wicksell. Examining an opinion that inflation might stimulate enterprise and free debtors, Wicksell says: “It need only be said that if this fall in the value of money is the result of our own deliberate policy, or indeed can be anticipated and foreseen, then these supposed beneficial effects will never occur, since the approaching rise in prices will be taken into account in all transactions by reasonably intelligent people.”

STRANGER Wicksell said that?

ATHENIAN Precisely that.

STRANGER It does sound very modern.

ATHENIAN Now Lucas speaks of how the advice that economists give should be limited only to “the well understood and empirically substantiated propositions of monetary economics, discouragingly modest as these may be.” What can we take him to mean? It seems to me he is sharing Friedman’s scepticism of the possibilities which had been claimed for macroeconomics by the keynesian consensus. And that surely has been a healthy scepticism, befitting good economists.

STRANGER As I said, there is so often a rush to belief.

ATHENIAN Which is really disastrous when combined with the craving for power.

STRANGER But the question remains, does it not, as to which propositions of monetary economics are to be considered “well understood and empirically substantiated”. I cannot help think the propositions taken to be well understood and empirically substantiated in Chicago may be very different from those taken to be well understood and empirically substantiated in Cambridge, or for that matter, those in the U. S. from those in Europe.

ATHENIAN I don’t see any difficulty in this. For first, it would have been granted there are propositions in economics which can be well understood and empirically substantiated. And that must be counted as progress! For something cannot be well understood if it cannot be understood at all, and where there is the possibility of understanding there must be the possibility of objective knowledge as well. And second, why should we not say the most appropriate task of economic theory or analytical economics is simply one of clarification and elucidation of the conceptual basis of economic thinking and expression? All theory ultimately is, or ought to be, “Critique of Language”. When we are faced with a particular and concrete problematic situation, the theorist is to whom we turn for conceptual guidance and criticism. If instead you take the role of the theorist to be one of searching the universe for grand and general and absolute and abstract truths, which need to be discovered before we can say anything about some concrete set of particulars, then it seems to me you will be either struck dumb by a total and debilitating scepticism or become very shrill in your dogmatism or alternate wildly between the two. To me it seems unimportant ultimately to whose flag one shows allegiance, or indeed that allegiance to any flag must be shown.

STRANGER It seems again I will not disagree. But you have sketched the critique of Friedman and Lucas and indeed the ghost of Wicksell addressed to the dogmas of the keynesian orthodoxy. And I have agreed with you this has been a healthy criticism of the sort we should expect economists to provide. But there has been serious question too of the framework used by Friedman and Lucas, hasn’t there? I am thinking especially of Tobin and Hahn.

ATHENIAN Tobin has done much to add clear and reasonable thinking about Keynes — his suggestion that a certain amount of inflation may be the only way to bring down real wages towards their walrasian rates in complex monetary economics is especially interesting; it shows how wide the common ground can be upon which the debate may occur. But you will have to tell me what Hahn’s criticisms have been. I have always found them too abstract and too caustic.

STRANGER That they tend to be, but don’t let that deter you. As I see it, Hahn argues somewhat as follows. We should grant Friedman and Lucas two important points: first, the government is itself a large economic agent whose actions and announced plans enter the calculations of private agents; secondly, erratic changes in monetary policy away from a steady k% rule may have perverse effects “by confusing signals of relative scarcity with those that arose from the monetary policy”. Also, we may accept that the assumptions sufficient for a full walrasian equilibrium with rational expectations suffice for the absence of any persistent involuntary unemployment by Keynes’s definition. But Hahn would say this may not be the relevant empirical description.

ATHENIAN In what way?

STRANGER Well for one thing the pricing axiom or the recontracting assumption of stability theory remains unexplained. It is possible traders will face quantity constraints, and this often seems so in markets for labour and credit. We may simply find prices not moving in the direction of excess demand even when a quantity constraint happens to be binding. The structure of wages may be “neither fixed, nor arbritrary, nor inflexible; it is what it is because given conjectures, no agent finds it advantageous to change it.” Moreover, it may not be plausible to suppose there will be convergence after arbitrary displacements back towards a stable equilibrium, because the conditions for stability are very stringent and uniqueness of equilibrium may also need to be postulated. Furthermore, it may be quite unsatisfactory to treat money in models which are isomorphic to the Arrow-Debreu model, because in such a world there is no logical use for money, so there must be some essential features of reality which have failed to be features of the model.

ATHENIAN You don’t think Patinkin’s integration was adequate?

STRANGER For many practical purposes perhaps, but certainly not to full logical satisfaction. If you put real money balances into the utility function and treat money just about like any other good, you have to be prepared to accept a possible equilibrium in which the price of money is zero. Lastly, if there are internal debts denominated in money as there are in fact, you may not assume equiproportional changes in all prices will not have real effects, unless you are prepared to assume away redistributions between creditors and debtors, which you can do only under another assumption that all households have parallel and linear Engel curves through the origin. Hahn’s line of argument is admittedly abstract, but you will have to admit it raises some fundamental questions.

ATHENIAN Another example we might say of the healthy scepticism of the theorist. It seems my turn to agree with you. But we can imagine replies too can we not?

STRANGER What do you have in mind?

ATHENIAN Well to argue there can be unemployment which is involuntary is not to have argued that an employment policy can be expected to remove it. This seems a premise and conclusion too frequently confounded by both keynesians and their critics, with disastrous consequences. Then, Buchanan would argue that a more thorough characterization needs to be given of the making of government policy, especially when it is proposed to supplant the market outcome. Policies are after all proposed, enacted, and put into effect by actual people — all of whom may need to be assumed to be pursuing private rewards as well in the course of their public duties. The relevant description for the economist needs to be one including this further fact that actual proposals of public policy can embody the private interests of the proposers too.

STRANGER Making it that much more difficult to determine what is in the public interest in a given case.

ATHENIAN Exactly. And so reinforcing the case for predictability and an orderliness in the framework of government.

STRANGER But we have been talking now for quite long enough my friend. I seem to feel a fear too that we have not gained anything at all in our discussions.

ATHENIAN Don’t be so pessimistic! Surely the point of reconstructing such conversations as we have done is not to hold absolutely to the matters raised in them. You and I after all have been making summary and highly simplified and unauthorized interpretations. I take the point of it to have been clarifying our thoughts, and perhaps to show ourselves how discussion can proceed between economists of different schools of thought. Arguments might come to a halt for any of a number of reasons, but they needn’t be supposed to have any logical or necessary end. Too often we let people retreat into different dogmatic positions, fostering the belief that each is starting from some set of absolute axioms ultimately irreconcilable with those of the other. We may need to keep insisting instead that the pursuit of knowledge and understanding is an open-ended activity with potentially indefinite limits. It yields conclusive results but has no absolute end. You or I might call a halt and retire from it, but that will not mean it cannot or will not continue without us.

STRANGER Perhaps so. But you are younger than I, and I have become tired by all these thrusts and parries. Besides, there has been the enjoyment of conversation itself.”

II

October 1929? Not! by Subroto Roy / First published in Business Standard September 18, 2008

“Lehman Brothers filing for bankruptcy protection, Merrill Lynch taken over by Bank of America, Fannie Mae and Freddie Mac and now AIG being nationalised by the US Government, Bear Stearns getting a government bailout, many thousands of low-quality loans going bad … Does it all add up to an American financial crisis in the autumn of 2008 comparable to that in the autumn of 1929? Even Alan Greenspan himself has gone on record on TV saying it might.

But there are overriding differences. Most important, the American economy and the world economy are both incomparably larger today in the value of their capital stock, and there has also been enormous technological progress over eight decades. Accordingly, it would take a much vaster event than the present turbulence — say, something like an exchange of multiple nuclear warheads with Russia causing Manhattan and the City of London to be destroyed — before there was a return to something comparable to the 1929 Crash and the Great Depression that followed.

Besides, the roots of the crises are different. What happened back then? In 1922, the Genoa Currency Conference wanted to correct the main defect of the pre-1914 gold standard, which was freezing the price of gold while failing to stabilise the purchasing power of money. From 1922 until about 1927, Benjamin Strong of the Federal Reserve Bank of New York adopted price-stabilisation as the new American policy-objective. Britain was off the gold standard and the USA remained on it. The USA, as a major creditor nation, saw massive gold inflows which, by traditional gold standard principles, would have caused a massive inflation. Governor Strong invented the process of “sterilisation” of those gold inflows instead and thwarted the rise in domestic dollar prices of goods and services.

Strong’s death in 1928 threw the Federal Reserve System into conflict and intellectual confusion. Dollar stabilisation ended as a policy. Surplus bank money was created on the release of gold that had been previously sterilised.

The traditional balance between bulls and bears in the stock-market was upset. Normally, every seller of stock is a bear and every buyer a bull. Now, amateur investors appeared as bulls attracted by the sudden stock price rises, while bears, who sold securities, failed to place their money into deposit and were instead lured into lending it as call money to brokerages who then fuelled these speculative bulls. As of October 22, 1929 about $4 billion was the extent of such speculative lending when Chase National Bank’s customers called in their money.

Chase National had to follow their instructions, as did other New York banks. New York’s Stock Exchange could hardly respond to a demand for $4 billion at a short notice and collapsed. Within a year, production had fallen by 26 per cent, prices by 14 per cent, personal income by 14 per cent, and the Greatest Depression of recorded history was in progress — involuntary unemployment levels in America reaching 25 per cent.

That is not, by any reading, what we have today. Yes, there has been plenty of bad lending, plenty of duping shareholders and workers and plenty of excessive managerial payoffs. It will all take a large toll, and affect markets across the world.

But it will be a toll relative to our plush comfortable modern standards, not those of 1929-1933. In fact, modern decisionmakers have the obvious advantage that they can look back at history and know what is not to be done. The US and the world economy are resilient enough to ride over even the extra uncertainty arising from the ongoing presidential campaign, and then some.”

III

America’s divided economists by Subroto Roy First published in Business Standard October 26, 2008

“Future doctoral theses about the Great Tremor of 2008 will ask how it was that the Fed chief, who was an academic economist, came to back so wholeheartedly the proposals of the investment banker heading the US Treasury. If Herbert Hoover and FDR in the 1930s started something called fiscal policy for the first time, George W Bush’s lameduck year has marked the total subjugation of monetary policy.

In his 1945 classic, History of Banking Theory, the University of Chicago’s Lloyd Mints said: “No reorganisation of the Federal Reserve System, while preserving its independence from the Treasury, can offer a satisfactory agency for the implementation of monetary policy. The Reserve banks and their branches should be made agencies of the Treasury and all monetary powers delegated by Congress should be given to the Secretary of the Treasury…. It is not at all certain that Treasury control of the stock of money would always be reasonable… but Treasury influence cannot be excluded by the creation of a speciously independent monetary agency that cannot have adequate powers for the performance of its task…” Years later, Milton Friedman himself took a similar position suggesting legislation “to end the independence of the Fed by converting it into a bureau of the Treasury Department…”(see, for example, Essence of Friedman, p 416).

Ben Bernanke’s Fed has now ended any pretence of the monetary policy’s independence from the whims and exigencies of executive power. Yet Dr Bernanke’s fellow academic economists have been unanimous in advising caution, patience and more information and reflection upon the facts. The famous letter of 122 economists to the US Congress was a rare statement of sense and practical wisdom. It agreed the situation was difficult and needed bold action. But it said the Paulson-Bernanke plan was an unfair “subsidy to investors at taxpayers’ expense. Investors who took risks to earn profits must also bear the losses. Not every business failure carries systemic risk. The government can ensure a well-functioning financial industry, able to make new loans to creditworthy borrowers, without bailing out particular investors and institutions whose choices proved unwise.”

Besides, the plan was unclear and too far-reaching. “Neither the mission of the new agency nor its oversight are clear. If taxpayers are to buy illiquid and opaque assets from troubled sellers, the terms, occasions, and methods of such purchases must be crystal clear ahead of time and carefully monitored afterwards…. If the plan is enacted, its effects will be with us for a generation. For all their recent troubles, America’s dynamic and innovative private capital markets have brought the nation unparalleled prosperity. Fundamentally weakening those markets in order to calm short-run disruptions is desperately short-sighted.”

The House’s initial bipartisan “backbench revolt” against “The Emergency Economic Stabilisation Act of 2008” (ESSA) followed this academic argument and rejected the Bernanke Fed’s advice. Is there an “emergency”, and if so what is its precise nature? Is this “economic stabilisation”, and if so, how is it going to work? The onus has been on Dr Bernanke and his staff to argue both, not merely to assert them. Even if the House “held its nose” and passed the measure for now, the American electorate is angry and it is anybody’s guess how a new President and Congress will alter all this in a few months.

Several academic economists have argued for specific price-stabilisation of the housing market being the keystone of any large, expensive and risky government intervention. (John McCain has also placed this in the political discussion now.) Roughly speaking, the housing supply-curve has shifted so far to the right that collapsed housing prices need to be dragged back upward by force. Columbia Business School economists Glenn Hubbard and Chris Mayer, both former Bush Administration officials, have proposed allowing “all residential mortgages on primary residences to be refinanced into 30-year fixed-rate mortgages at 5.25 per cent…. close to where mortgage rates would be today with normally functioning mortgage markets….Lower interest rates will mean higher overall house prices…” Yale’s Jonathan Koppell and William Goetzmann have argued very similarly the Treasury “could offer to refinance all mortgages issued in the past five years with a fixed-rate, 30-year mortgage at 6 per cent. No credit scores, no questions asked; just pay off the principal of the existing mortgage with a government check. If monthly payments are still too high, homeowners could reduce their indebtedness in exchange for a share of the future price appreciation of the house. That is, the government would take an ownership interest in the house just as it would take an ownership interest in the financial institutions that would be bailed out under the Treasury’s plan.”

Beyond the short run, the US may play the demographic card by inviting in a few million new immigrants (if nativist feelings hostile to the outsider or newcomer can be controlled, especially in employment). Bad mortgages and foreclosures would vanish as people from around the world who long to live in America buy up all those empty houses and apartments, even in the most desolate or dismal locations. If the US’s housing supply curve has moved so far to the right that the equilibrium price has gone to near zero, the surest way to raise the equilibrium price would be by causing a new wave of immigration leading to a new demand curve arising at a higher level.

Such proposals seek to address the problem at its source. They might have been expected from the Fed’s economists. Instead, ESSA speaks of massive government purchase and control of bad assets “downriver”, without any attempt to face the problem at its source. This makes it merely wishful to think such assets can be sold for a profit at a later date so taxpayers will eventually gain. It is as likely as not the bad assets remain bad assets.

Indeed the University of Chicago’s Casey Mulligan has argued there is a financial crisis involving the banking sector but not an economic one: “We’re not entering a second Great Depression.” The marginal product of capital remains high and increasing “far above the historical average. The third-quarter earnings reports from some companies already suggest that America’s non-financial companies are still making plenty of money…. So, if you are not employed by the financial industry (94 per cent of you are not), don’t worry. The current unemployment rate of 6.1 per cent is not alarming, and we should reconsider whether it is worth it to spend $700 billion to bring it down to 5.9 per cent.”

Dr Bernanke has been a close student of A Monetary History of the United States in which Milton Friedman and Anna J Schwartz argued that the Fed inadvertently worsened the Great Contraction of 1929-1933 by not responding to Congress. Let not future historians find that the Fed, at the behest of the Treasury Secretary, worsened the Great Tremor of 2008 by bamboozling Congress into hasty action.”

IV

Would not a few million new immigrants solve America’s mortgage crisis?

October 10, 2008 — drsubrotoroy | Edit

America was at its best when it was open to mass immigration, and America is at its worst when it treats immigrants with racism and worse (for seeming “uppity”).

All those bad mortgages and foreclosures could vanish within a year or two by playing the demographic card and inviting in a few million new immigrants into the United States. They would pour in from China, Vietnam, Thailand, Philippines, Indonesia, Mexico, South America, South Africa, Nigeria, Egypt, Israel, Poland, Romania, Hungary, Belarus, Ukraine, Russia, Uzbekistan, Kazakhstan, India, Sri Lanka, Bangladesh, and yes, Pakistan too, and more. They would happily buy up all those empty houses and apartments, even in all those desolate dismal locations. If the USA’s housing supply curve has moved so far to the right that the equilibrium price has gone to near zero, the surest way to raise the equilibrium price would be by causing a new wave of immigration leading to a new demand curve arising at a higher level. But yes, nativist feelings of racism towards the outsider or the newcomer would have to be controlled especially in employment — racists after all are often rather “sub-prime” themselves and hence unable to accept characters who may be “prime” or at least less “sub-prime” from foreign immigrant communities. Restoring a worldwide idea of an American dream fuelled by mass immigration may be the surest way for the American economy to restore itself.

V

122 Sensible American economists

September 26, 2008 — drsubrotoroy | Edit

“$700 billion comes to more than, uhhhm, $6,000 per income taxpayer in the USA.

I was glad to see the sensible letter of 122 American economists to US legislators regarding the Paulson-Bernanke plan to address America’s financial crisis.

Somehow, I have an inkling that foreign central banks have been left holding more bad US debt than might be remembered — which would explain the embarrassment of Messrs Paulson and Bernanke vis-a-vis their foreign counterparts… Dollar depreciation and an American inflation seem to be inevitable over the next several years.”